Description

I am looking for a serious buyer to takeover one of my many property rental business. $30,000 is the takeover fee of this cashcow business.

You will have to borne for the rental fee separately on your own at $4,000 per month with the landlord or at the prevailing market rate.

In this takeover, you will receive:

-1 Private Residential Condominium Unit Lease in The West

-3 Years Renewal Worth of Rental Income with Tenancy Agreement (If you wish to renew, lease expiring in 2022)

-1 Month Mentorship (this is what you are essentially paying for, I will handhold you until all your units get tenanted out)Property: The Rochester ResidencesSize: 1302 SqftTOP in 2011Newly Renovated in 2020

4 Bedroom Apartment, with 3 Toilets.

Spent $10k on renovation and furnitures.Selling with fittings, tenancy and business

- $100,000 gross revenue per unit.

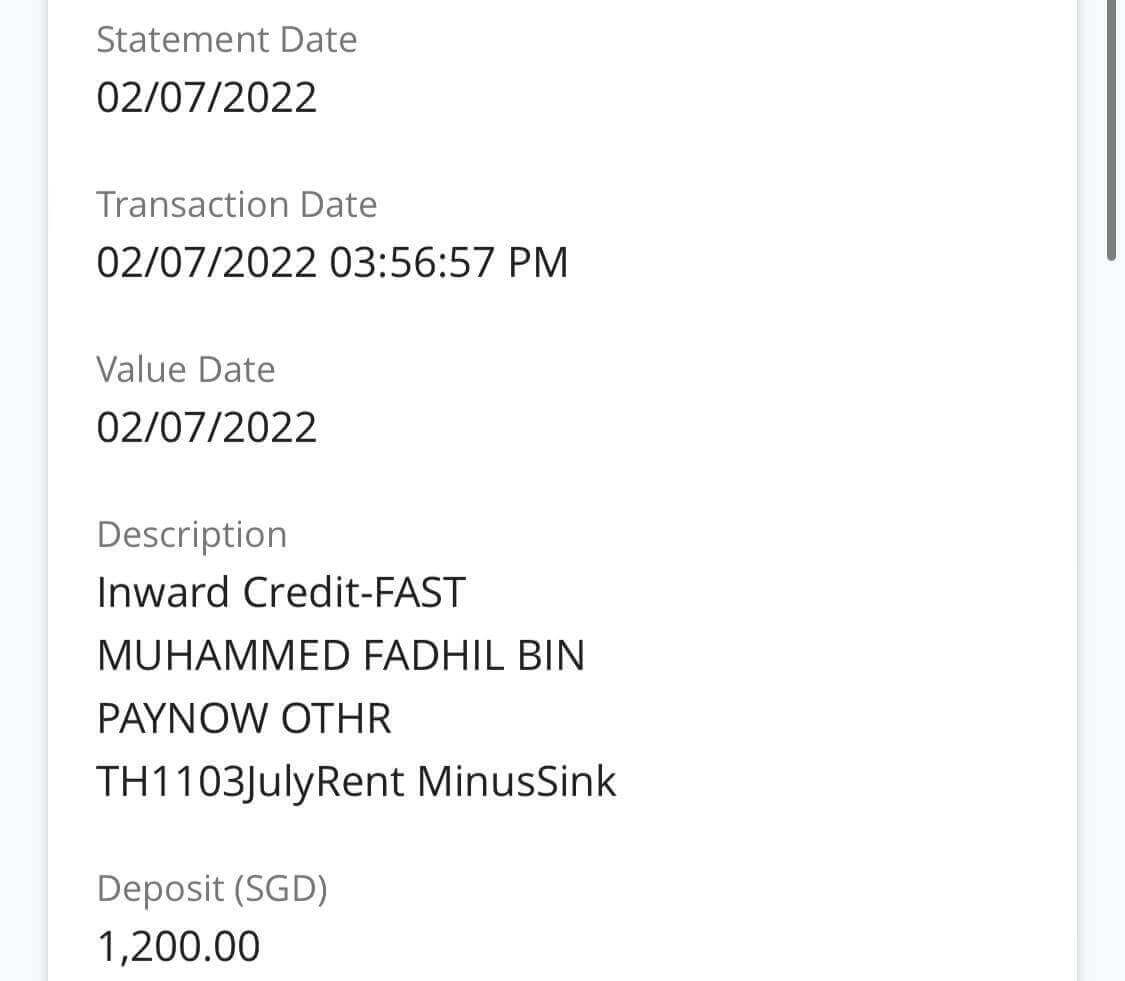

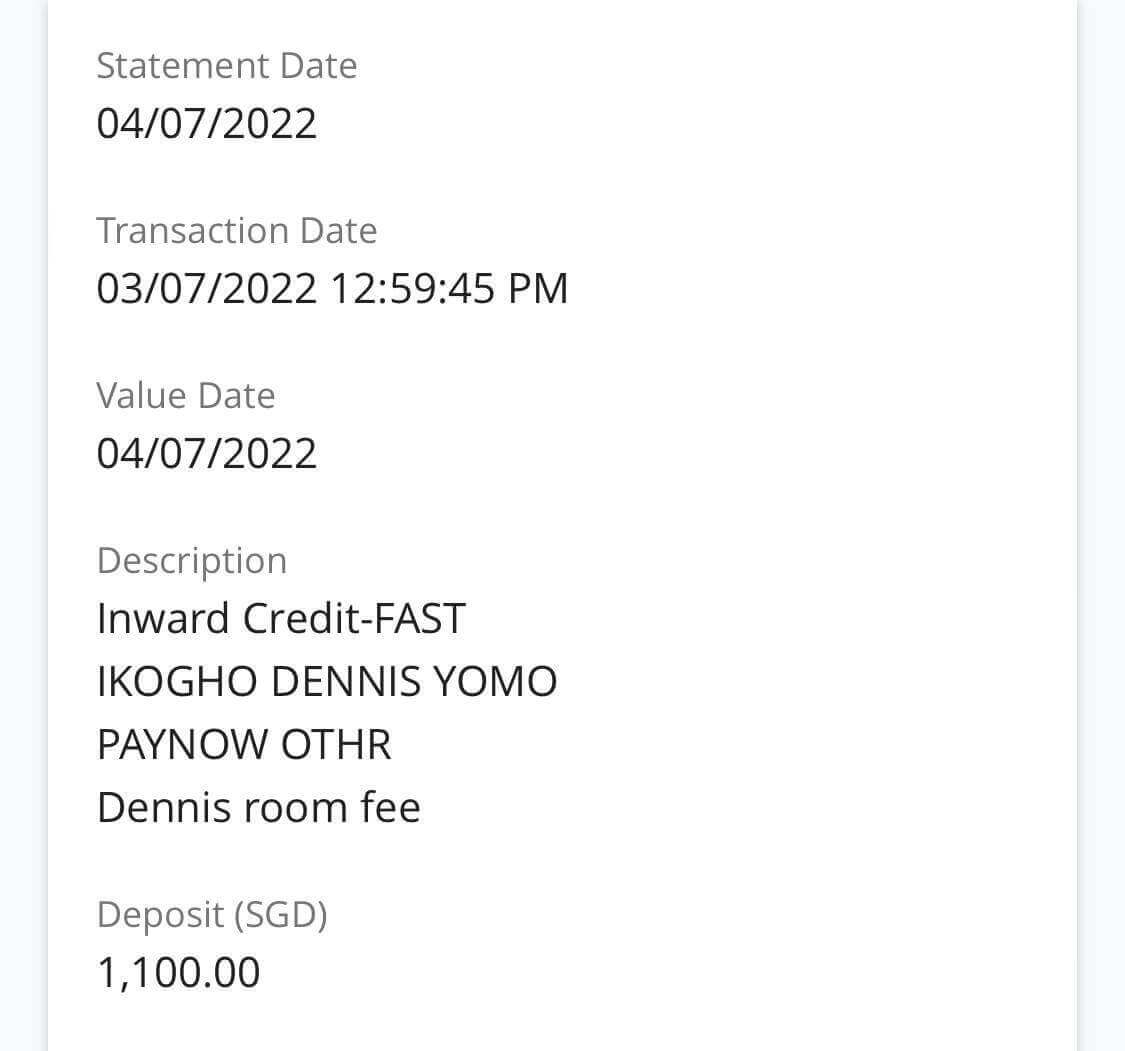

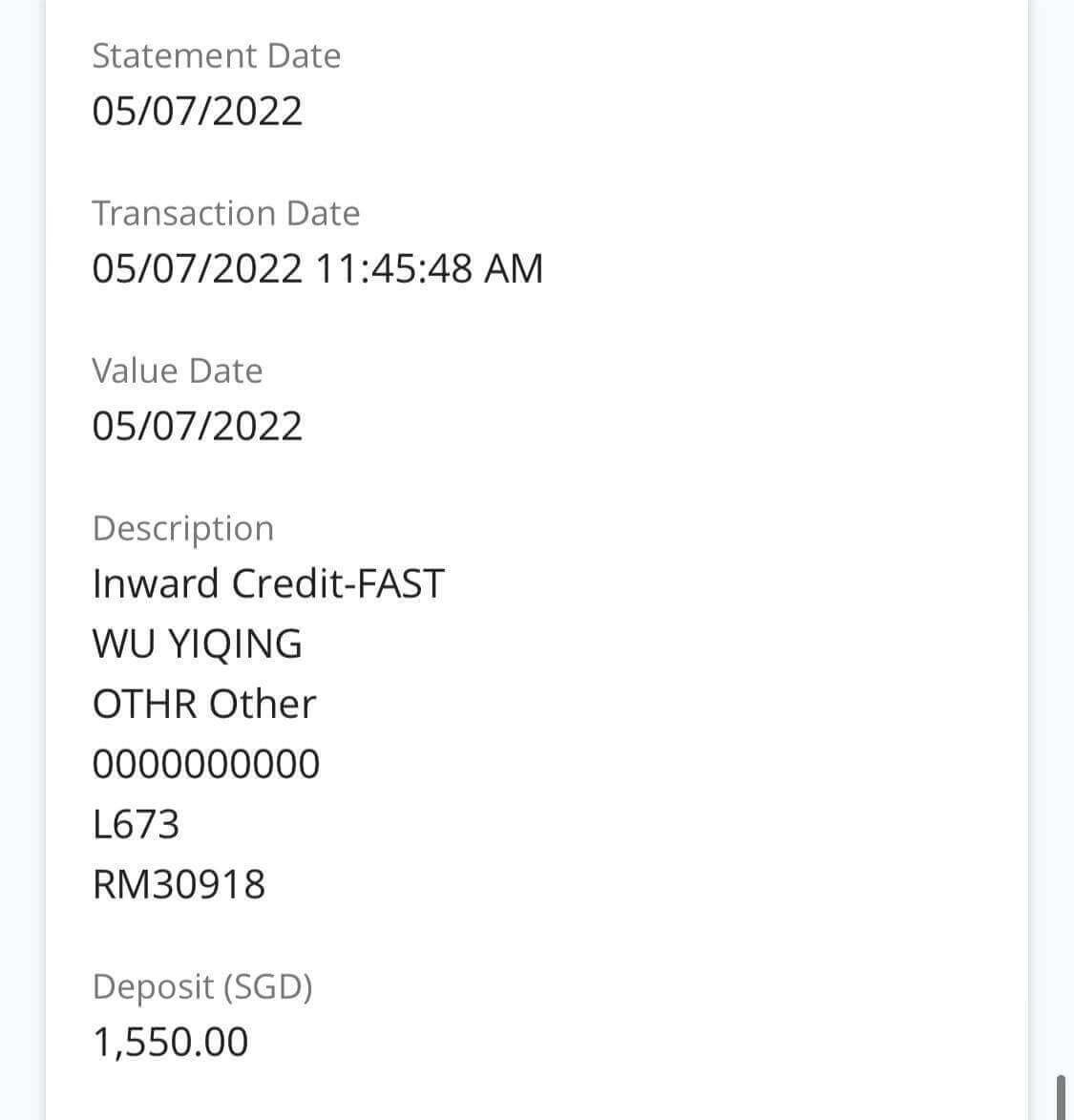

Good tenants, always paying on time.Come with existing wifi, electrical settings, sliding door.

My profit margin is at least 200%.

My positive cashflow every month after deducting all agent commission, running costs, utilities, PUB, WIFI is at least $1,500.

Who said you have to pay for downpayment, taxes, ABSD to earn massive rental income for SG residential properties? Reason for selling, we recently sold away our family car.

I don’t have the time to manage the operational side and servicing of tenant.

This is perfect if you are looking to earn side income and have the time commit. I personally live in the east, travelling to the West is a hassle. I would recommend taking up units that are near your home-stay.Is it 100% passive? NO. You require handwork.

If you think this is a get rich quick scheme, please do not enquire. If you have a million of things, business ventures on hand, then this is definitely not for you.

The main bulk of this business is servicing of clients, opening keys, handing over the unit, managing the tenants.

I took about 5 months of testing, spending thousands of dollar attending seminars and courses. I will be transferring all this knowledge to you as well.

I just wished there was someone there telling me to avoid all these pitfalls in the beginning.

I think most of these gurus teach you HOW to do it, but they don’t necessarily guide you through the process one by one and you don’t receive 1-1 attention.

You can skip all the trial and error, costly mistakes, selecting the wrong property unit. Everything is up and running already.

I hope to empower someone from this small venture, let me know your “WHY”.

I have a property portfolio of 5 private residential units under me right now currently. Letting go one of this unit is not much of a difference for me, tell me why you’re a good fit and why I should coach you.

You can PM me to discuss more or over a meet-up.